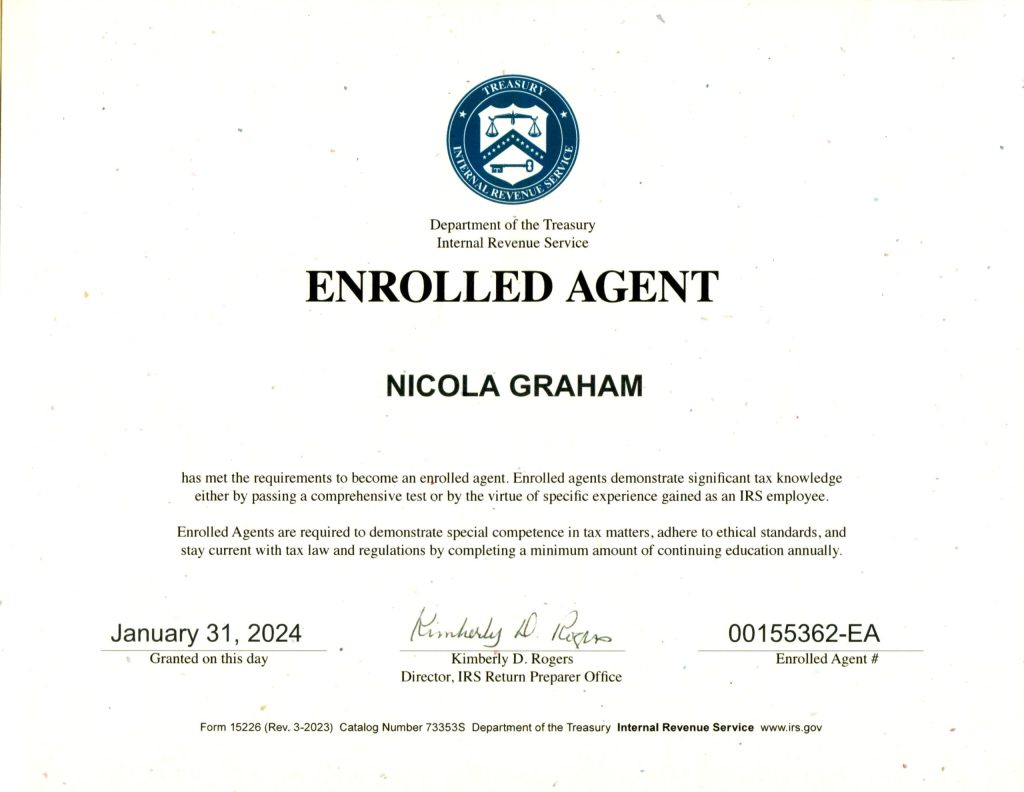

Nicola Graham, Enrolled AgentMeet Nicola, from Connecticut, an enrolled agent, the highest credential awarded by the IRS. Nicola offers personalized tax services for individuals gig workers and sole proprietorships.

Meet Nicola, from Connecticut, an enrolled agent, the highest credential awarded by the IRS. Nicola offers personalized tax services for individuals gig workers and sole proprietorships.

My Background and Philosphy

I am originally from the Caribbean, my professional background spans software engineering, project management, data analytics and finance. I have a real passion for tackling complicated problems. Beyond my technical abilities, I bring a range of soft skills to the table, with a particular joy in helping others.

I know you have a lot of choices when it comes to tax preparers. There are many talented experts out there who do a great job. Unfortunately there are also people who don't. But I want to offer you something different. When you choose me to handle your taxes, I promise to give them my utmost attention and care.

I'm the first to admit that I don't know everything – nobody does. I'm committed to always learning and improving. I keep a network of professional resources on hand, so I can find answers and clarification when needed. An inaccurate tax return can cause a lot of issues, and I’m here to make sure that doesn’t happen to you. Plus, I'm available year-round for any questions you might have.

I am a proud member of the National Association of Tax Professionals as seen by my certificate here.

I am a proud member of the National Association of Tax Professionals as seen by my certificate here.

Is an Enrolled Agent the same as a CPA?

No, the main difference between a Certified Public Accountant (CPA) and an Enrolled Agent (EA) is that EAs specialize in taxation. Enrolled agents need to take 3 comprehensive, proctored exams, pass suitability and background tests before the IRS approves their credential. EAs can represent taxpayers in front of the IRS for unlimited tax matters.

A CPA is an accountant, and many CPAs also specialize in taxation, but some focus on other accounting areas.

Both CPAs and EAs are credentialed and knowledgable professionals who are required to maintain high ethical standards. Tax preparers without a credential also prepare tax returns, and many tax preparers are ethical professionals with a lot of experience, but they have limited practice rights with the IRS. If you need representation for an audit for example, EAs, CPAs and attorneys are your best options.

Whoever you choose, make sure you are comfortable with that person, as they will be handling some of your very sensitive information. Be sure to ask your tax professional how they are keeping your data safe and private.

Both CPAs and EAs are credentialed and knowledgable professionals who are required to maintain high ethical standards. Tax preparers without a credential also prepare tax returns, and many tax preparers are ethical professionals with a lot of experience, but they have limited practice rights with the IRS. If you need representation for an audit for example, EAs, CPAs and attorneys are your best options.

Whoever you choose, make sure you are comfortable with that person, as they will be handling some of your very sensitive information. Be sure to ask your tax professional how they are keeping your data safe and private.